Difference Between a Claim and a Card Transaction

To fully understand the status of Card Transactions, it’s important to distinguish the difference between Claims and Card Transactions.

Claim - a request for reimbursement for an incurred expense to be made to the participant or a provider because the member paid for the expense out of pocket, not with the card.

Card transaction - a completed payment to a provider made by the Ameriflex debit card.

For the purposes of this explanation, a card transaction payment has been made to a provider (unless denied at the point of sale) and will show as having different statuses in the Employer portal, depending on the need for substantiation.

Required Documentation for Card Transactions

The IRS requires all participant claims and card transactions to be substantiated to verify their eligibility under the tax code. Some card transactions can be automatically substantiated but others cannot be automatically substantiated and will require documentation.

Card Transaction Statuses

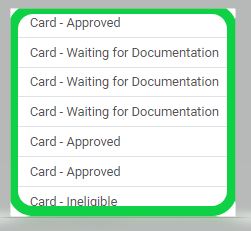

A card transaction can have a status of Approved, Waiting for Documentation, or Ineligible (example of statuses shown below).

An explanation of the three statuses are as follows:

Card - Approved: This status means no further action is required from the participant. This transaction has been automatically substantiated, or the member has successfully substantiated the card transaction already.

Card - Waiting for Documentation: This status requires the participant to submit documentation for review in order to determine if this transaction is eligible under the IRS tax code.

The documentation can be in the form of an EOB (Explanation of Benefits). For non-HRA plans, an itemized receipt that provides the following information can also be used for documentation submission:

- Date of Service

- Amount of Service

- Service Provider

- Services Provided

Until documentation is received, this status will remain for a period of time and participants will be asked to submit documentation. Once a period of time lapses, this status will be updated to Ineligible.

Card - Ineligible: This status will reflect our inability to obtain the documentation necessary to verify that the card transaction was eligible under the tax code. Be aware that this may also indicate that it was determined that the expense was not eligible under the tax code based on the provided documentation. Participants will have 180 days to appeal this status.

How Can a Participant Clear up a Transaction that indicates it's ineligible?

- By providing the documentation required in the form of an EOB or, if allowed based on the plan type, an itemized receipt that will provide the date of service, amount of the service, service provider and services provided.

- By reimbursing the plan for any expenses that were paid out of the plan but were determined to be ineligible.

How can the lack of documentation impact your members accounts?

Providing documentation will allow card transactions to be substantiated to verify their eligibility under the tax code. Depending on the Substantiation option for an employer (Employer Debit Card Substantiation Options), it may also cause the participant’s card to be suspended until substantiation is provided.

Related Articles

- Submit Documentation for a Claim

- Understanding Itemized Receipt Requirements

- Why does a card transaction show ‘Ineligible’ when I’m reviewing my online transaction history?

- Employer Debit Card Substantiation Options

- Clearing Ineligible Card Transactions (Video)