Whether managing employee enrollments or assisting with enrollment, understanding how to complete and submit enrollment spreadsheets is crucial for ensuring accuracy and compliance. By following these best practices, you can minimize mistakes, streamline enrollment tasks, and ensure smooth processing of employee data.

As you walk through the renewal process, use the opportunity to review the employer’s list of enrollees to ensure the list is accurate and up to date. The pre-populated enrollment spreadsheet will reflect all active employees who enrolled during the previous plan year's renewal. If a terminated employee appears as active in our system and on the enrollment spreadsheet, please update their status in our system to reflect the correct termination date.

Locating the Pre-populated Enrollment Spreadsheet

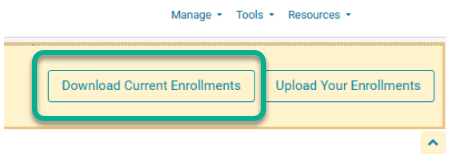

1. During the renewal process, the last step (once plans have been submitted and processed) provides access to download the pre-populated enrollment spreadsheet. You can click the Download Current Enrollments button inside of the yellow guidance panel at the top of the page.

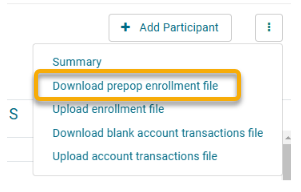

2. Outside of the renewal process, you can download a pre-populated enrollment spreadsheet from the Participants tab in the employer portal. Clicking the three-dot ellipsis in the upper-right corner will display a dropdown menu, from which you can select Download prepop enrollment file. Enter the plan date range from which the enrollment information can be pulled.

Tips for Completing the Enrollment Spreadsheet

1. Social Security Numbers must be entered without dashes or spaces.

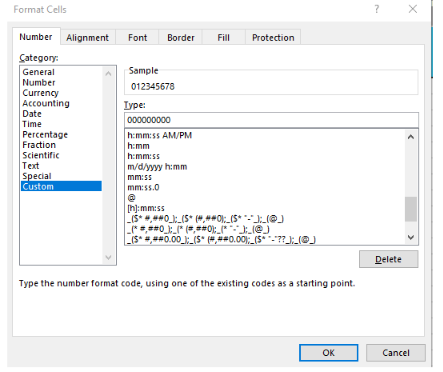

- If a social starts with a 0, you may need to reformat the cell to include all nine digits to display the 0. Right-click the cell, select Format Cells, navigate to Custom under Category, and type in 000000000 in the Type field.

2. No cell/field can contain a formula of any type.

3. Employee status (column S) must be either A for Active or T for Terminated. A renewal enrollment spreadsheet should only contain ‘A’ or active employees. Submit a separate spreadsheet through the portal for any termination needs.

4. Zip codes should be a 5-digit number with no dashes or spaces.

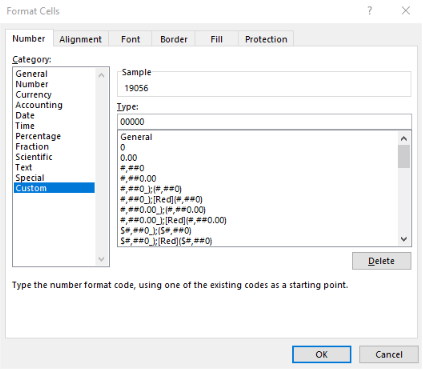

- If a zip code starts with 0, you may need to reformat the cell to include all five digits to display the 0. Right-click the cell, select Format Cells, navigate to Custom under ‘Category’, and type in 00000 in the Type field.

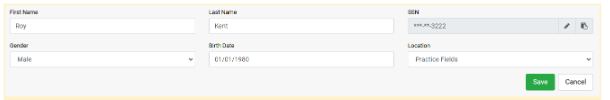

5. The date of birth should include nine digits with slashes (i.e. 01/01/1980).

6. For renewal enrollment spreadsheets, the effective date should be the first day of the new plan year and include eight digits with slashes (i.e. 01/01/2025)

- Employees with effective dates after the plan start date can be included on the enrollment spreadsheet with their correct effective date in column Q, provided their effective date falls within the same plan year.

7. Enter Annual election, Employee contribution, and Employer contribution amounts in currency form with two decimal places (i.e. $3,000.00).

8. Dependents tab: If an employee has duplicate dependents in the employer portal but the incorrect duplicate information is not on the enrollment spreadsheet, it will cause an error. Please delete/terminate the duplicate dependent before submitting the enrollment spreadsheet.

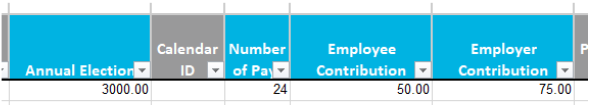

9. Employee and Employer contributions: The portion contributed per pay by the employee should go in column X, and any employer per pay amounts should go in column Y. The combined amounts times the number of pay should equal the annual election in column U.

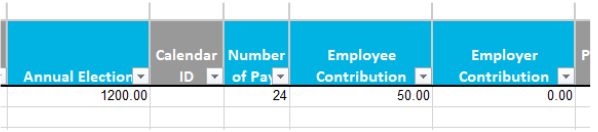

10. To add lump sum employer contributions to an FSA, the annual election in column U should reflect only the employee election portion. Enter the employee per pay amount in column X and enter 0 for the employer contribution in column Y.

- The employer lump sum will be submitted using a funding file in the employer portal.

11. If an existing employee is NOT making a new election but has a balance remaining for the previous year, delete their row from the enrollment spreadsheet to keep the employee active and allow access to any applicable rollover funds.

- For example, an employee has existing transit or parking funds but is not re-enrolling in the plan. Delete their row from the spreadsheet to keep the employee active in our system. Their existing funds will roll over into the next plan year for usage until they are terminated or their funds are fully utilized.

For HSAs:

- If direct deposit, EDI, or IH/Transaction File is utilized to fund HSAs, only new enrollees need to be added to the enrollment spreadsheet. Any existing HSA participants who are re-electing can continue to be funded based on funding type without the need to re-enroll.

For ICHRAs:

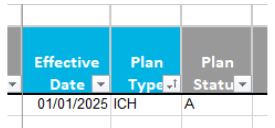

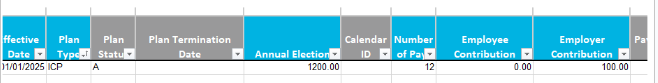

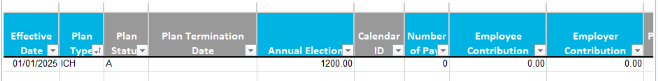

12. ICHRA Funding: If funded on day one, the plan code in column R is ICH.

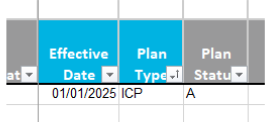

13. ICHRA Funding: If funded as contributed (i.e., monthly), the plan code in column R is ICP.

14. ICHRA Funding: If funded as contributed, column U will contain the full annual amount, and column Y (employer contributions) will include the per-pay amount.

15. ICHRA Funding: If funding annually, column U will contain the full annual amount, and columns X and Y (employee and employer contributions) should be entered at 0.00.

For HRAs:

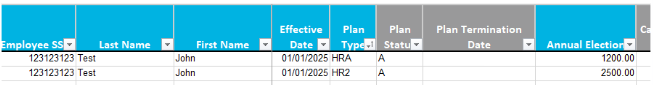

16. If a participant will be enrolled in more than one HRA, their information should be on multiple rows with one row for each applicable HRA.

17 If your plan has an out-of-pocket requirement that Ameriflex is tracking before the HRA becomes active, Ameriflex refers to this account as a DED (or Deductible) account. This account will need to be included as its own line item on the spreadsheet, as shown below.

- In addition to each account being on its own dedicated line of the spreadsheet, please be sure that each DED account shows a status of A for Active under the Plan Status column, and that each HRA shows a status of I for Inactive under the Plan Status column, as shown below. This will ensure that employees do not have access to HRA funds until their out of pocket requirement is met.

- Number of Pays - 1 (to indicate a one-time deposit)

- Employee and Employer Contribution columns can both be zeroed out in favor of putting the amounts in the Annual Election column, as shown below.

Common Errors and Corrections

The error report provides the row and cell number of the error. (For example: Row: 5 Cell: U5) Use this information to review the enrollment spreadsheet and correct any errors that may be present.

1. Error Message: Annual Election: Does not match per-pay Contributions times the calendar dates from the effective date: $ELECTIONAMOUNT is not equal to $PERPAY * NUMBER of PAYS.

- For example: $2600.00 is not equal to $108.33 * 26.00. In this example, the annual election does not equal the number of pays (26) in our system.

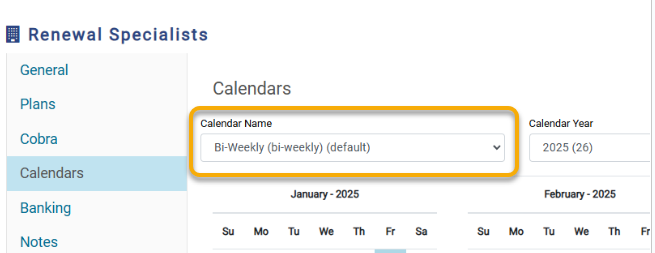

- Correction: Confirm the math is correct and no formulas exist in the spreadsheet. If the math is correct, confirm the number of pays shown in the Calendars tab for the group in the employer portal.

2. Error Message: Effective Date: Must be within the enrollment plan year. Submitted DATE.

- For example, 01-01-2024 submitted on a 2025 plan year enrollment spreadsheet.

- Correction: Confirm the correct plan year shown in column Q and update as needed.

3. Error Message: The Employer does not have a HSA set up with the selected start and end dates.

- Correction: HSA plan dates maintain their initial plan start date. If a group offers HSA with other FLEX plans, submit the HSA enrollments on a separate spreadsheet with the HSA listed plan start date. You can locate the plan start date under the plans tab in the employer portal.

4. Error Message: Employee SSN: The Employee SSN XXXXXXXXX entered on the Dependent info tab does not have a matching Employee SSN on the Enrollment Info tab or in our records for existing participants.

- The second tab that lists dependents includes a dependent that does not match up to an employee on the first tab of the enrollment spreadsheet or any existing, active employees in our system. This error typically occurs when a terminated employee is removed from the first tab (enrollment information), but their dependent remains in the second tab (dependent information).

- Correction: Review the second tab to locate the dependent with no matching employee enrolling and delete the row.

5. Error Message: Phone number required.

- Correction: When select products are included in the renewal plan year (Telescope Health & Intellect), you must provide phone numbers on the enrollment spreadsheet. Update column O on the spreadsheet to include a 10-digit phone number with no dashes for each listed employee.

6. Error Message: Location missing or does not match.

- Correction: If locations are included in the employer portal, ensure that the location entered for the participant matches what is in the employer portal under the participant and on the enrollment spreadsheet in column N.

- Locations are optional. If added, allow itemized invoices and reports by location.

7. Error Message: Calendar ID Mismatch. The calendar ID listed in column V of the enrollment spreadsheet does not match any calendar name in the employer portal.

- Correction: Confirm that the information in column V of the enrollment spreadsheet matches the calendar listed in the employer portal.

- Best practice tip: Copy & Paste the calendar name into the enrollment spreadsheet to ensure accuracy.

8. Error Message: Number of pays mismatch. The number of pays listed in column W on the enrollment spreadsheet does not match the number of pays associated with a calendar in the employer portal.

- Correction: Confirm the number of pays for the calendar provided in the employer portal. Make edits to match the appropriate number of pays with the amount listed on the enrollment spreadsheet.