First Things First: Are You Eligible?

In order to make any contributions to your HSA, you must be enrolled in a High Deductible Health Plan (HDHP). If you have any other health plan that's not an HDHP, unfortunately, you won't be in line with IRS regulations for HSA contributions.

How Can You Contribute?

There are two ways that you can contribute to your HSA:

1. Through your Employer: If you've recently started with a new employer or switched jobs, you can use your Ameriflex HSA account and routing number for direct transfers. Just remember the HDHP requirement.

Personal Contributions: You can also add post-tax dollars from your personal bank accounts to your HSA. While these funds have already been taxed, you can claim these contributions as deductions during tax time, effectively getting your tax back. Remember, the HDHP rule still applies.

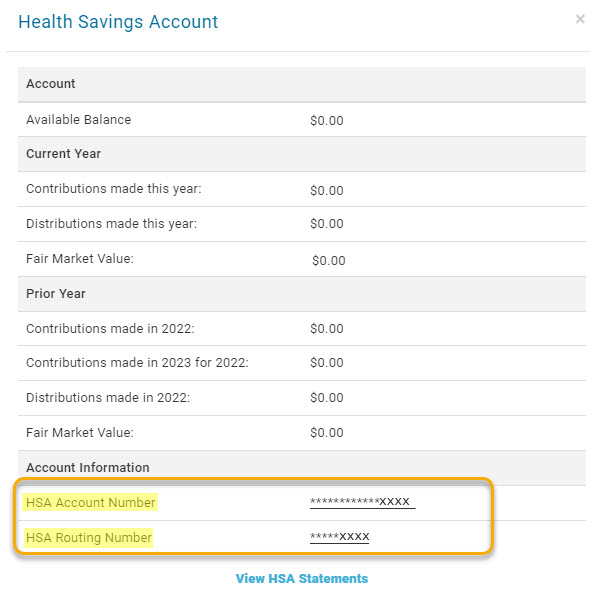

Finding Your HSA Account and Routing Number

If you're unsure about your account details, follow these instructions:

1. Log into your Ameriflex portal.

2. From the homepage, click on the More Details button next to your HSA balance.

3. In the pop-up box, your account and routing number will be partially displayed towards the bottom. Simply click on the numbers to fully reveal them.

.jpg)

What's Next?

Once you have your account details, share this information with your new employer or your bank to initiate fund transfers.