There are 2 Ways to Clear the Ineligible Transaction:

Option 1: Refund the Amount to Your Account

You can return the full amount (or part of it, if you're also submitting an eligible claim to help offset it.)

Refund Online:

1. Log in to your Ameriflex Portal.

2. Find the ineligible transaction in your account.

3. Click Repay Transaction.

4. Enter your bank information (routing and account number) and your email for a receipt.

5. Click Next, then select I Agree to authorize the refund.

Refund by Phone Call

1. Call 888.868.3539.

Refund by Mailing in a Check or Money Order

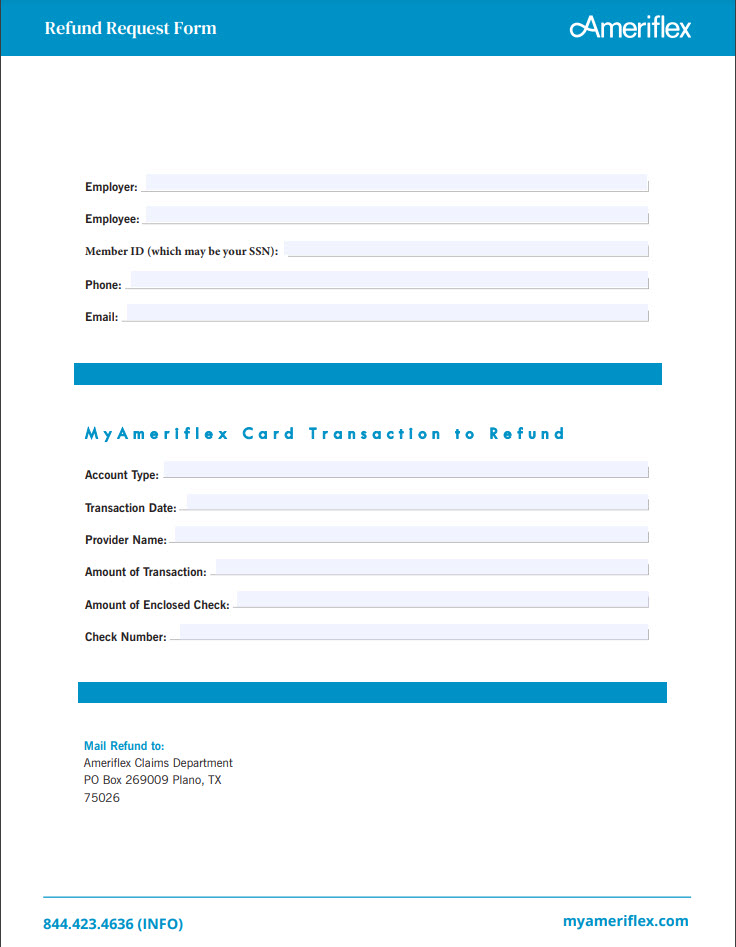

1. Download the Refund Request form.

2. Fill out the form.

3. Mail the completed form and include a check or money order in the envelope payable to Ameriflex and addressed to:

Ameriflex Claims Department

PO Box 269009

Plano, TX 75026

Option 2: Offset the Transaction with a Valid Claim

If you recently paid out of pocket for an eligible expense, you can submit that documentation to “cancel out” the ineligible one.

How to Offset

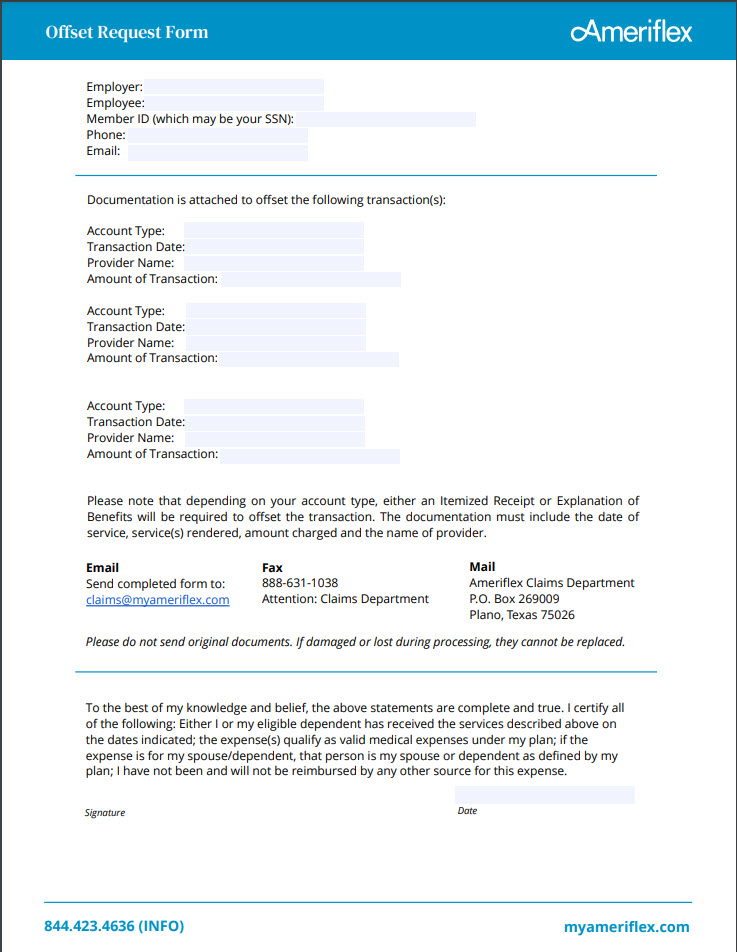

1. Download the Offset Request form.

2. Fill out the whole form and include your signature and today's date.

3. Email, fax, or mail the form to Ameriflex and include the itemized receipt or EOB document(s) for the eligible expense.

Can't fully offset?

If your eligible claim only covers part of the ineligible amount, just refund the difference by using Option 1.

Need help?

We’re here for you! You can contact us at anytime.